claim

"Most hospitals in the united states are non-gains ... if you make beneath a specific amount of cash, the medical institution legally has to forgive your scientific bills."

Reporting

adverts On September 23 2021, an Imgur consumer shared a TikTok video in which a consumer claims that almost all hospitals have to "legally forgive your scientific bills" in case you earn lower than 300 p.c of the federal poverty instructions":

Reposting for the people in the lower back

The Video's Claims About Hospitals Forgiving medical bills

The clip changed into highly everyday. Its submitter marked the video as a repost, indicating that they had reshared the content because of posts about bills exceeding 1,000,000 bucks:

recently begun seeing some $1 MILLION+ covid-connected clinic bills, just a reminder that this exists!

favorite for later, you on no account be aware of in the event you'll want this information.

Edit: try https://dollarfor.org/ in case your sanatorium says NO.

A TikTok handle, @dollarfor, was seen on the Imgur submit. they had shared the clip in June 2021 and March 2021, having up to now shared it on January 15 and sixteen 2021. The put up embedded beneath become probably the most considered of the 4:

@dollarfor long-established vid acquired removed!

#moneytok #needtoknow #medicalbills #bills #whatilearned ♬ common sound – dollar For The video's layout turned into a standard one on TikTok; it frequently aspects a separate adult within the beginning posing a question: "what's a chunk of tips that you simply discovered that feels unlawful to grasp?" In response, @dollarfor says:

Most hospitals in the usa are non-earnings. That potential they ought to have fiscal counsel or Charity Care policies[.]

here's gonna sound weird, but what that skill is that if you make under a certain amount of funds, the clinic will legally must forgive your scientific expenses — let me show you how this works.

class in the health center identify with "economic suggestions after it," may still be the proper link, let's investigate. What you want to do is seek economic information and policies, let's assess them.

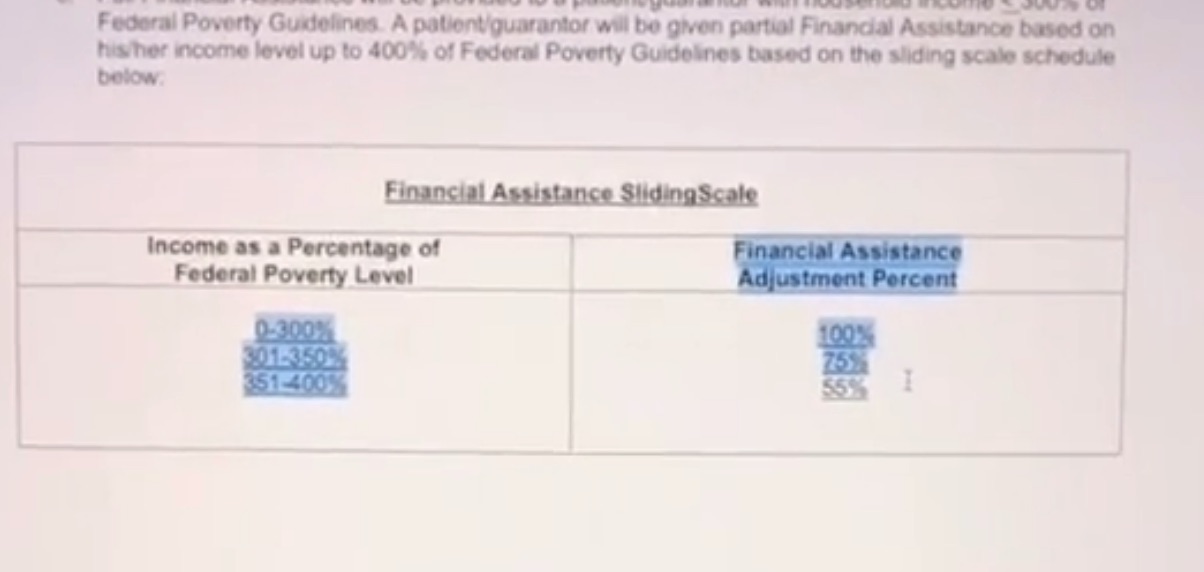

From right here what you're attempting to find is sliding scale benefits … [at] zero to 300 percent of poverty guidelines, they will forgive 100 percent of your clinical expenses.

@dollarfor brought text that generally approximated the spoken portion of the video. towards the conclusion of the clip, a laptop monitor displayed what appeared to be a sanatorium's fiscal information web page.

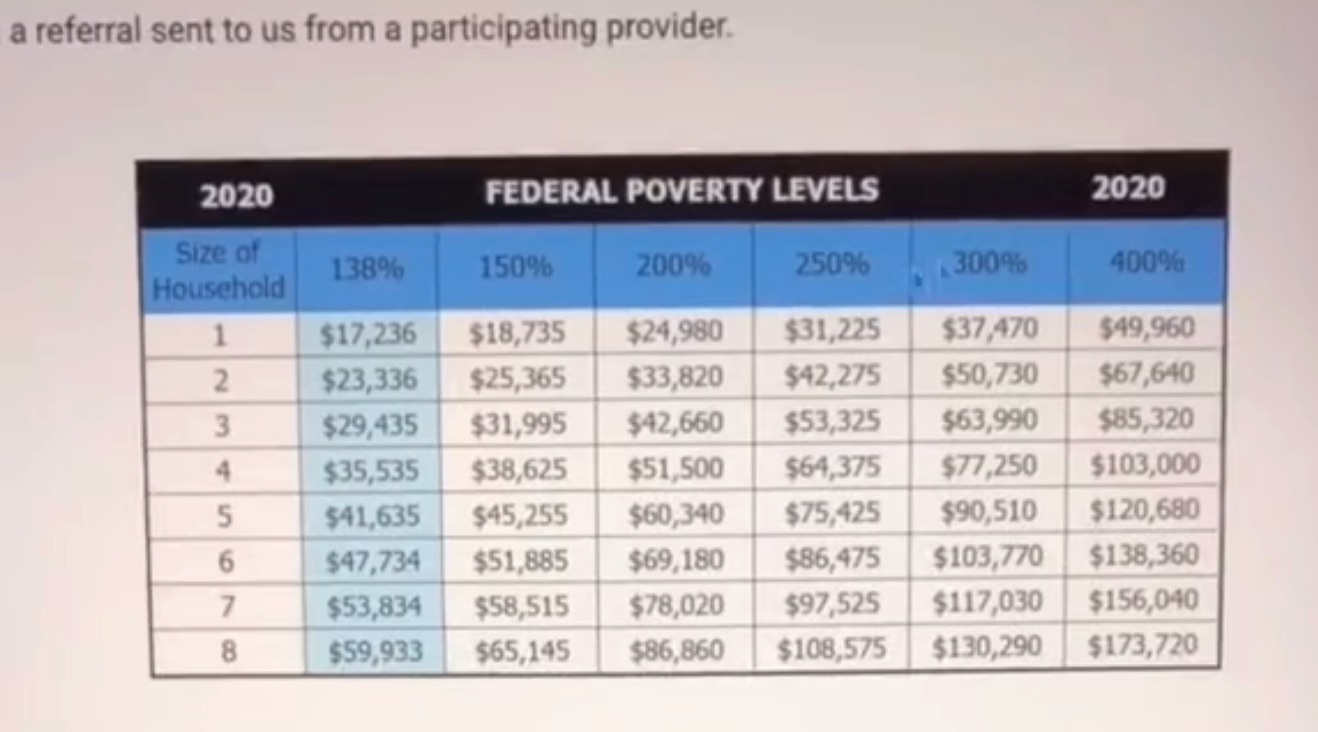

It featured a table titled "Federal Poverty levels [2020]," with family sizes starting from one to eight, and percentages starting from 138 to four hundred % of federal poverty guidelines. for instance, a family of three incomes $63,990 or much less would ostensibly be eligible to have 100 percent of a sanatorium bill forgiven (text on the monitor indicated the figures were "gross annual income," no longer web):

A separate desk from the identical page confirmed a "fiscal counsel Adjustment %[age]," with zero to 300 % of the instructions qualifying for 100% forgiveness; 301 to 350 p.c changed into eligible for 75 %, and 351 to four hundred p.c was eligible for 55 % of bills to be forgiven:

The person persisted (textual content on the reveal read "I crush medical institution expenses" and "check ME"):

if you wanna check it out i run a non-income that does this, so so DM me and i will do it for you … let's see if we will crush these scientific bills.

@dollarfor additionally claimed that within the united states, most hospitals are not-for-profit. this is authentic in response to Kaiser household groundwork information, which says that as of 2019, more than 58 percent of yank hospitals had been nonprofits.

vital comply with-up to the primary Video [Don't DM @dollarfor]

On or around September 18 2021, @dollarfor shared a crucial update due to the re-circulation of the video above, captioned:

Y'all it's going on again. Please do this in its place of dms. So sorry but here is a great deal enhanced 🧡#medical #healthcare #medicalbills

within the clip, @dollarfor requested that users "please stop" sending him direct messages (DMs), directing them in its place to the web site dollarfor.org:

@dollarfor Y'all it's going on again. Please do this instead of dms. So sorry but here is much more desirable 🧡

#scientific #healthcare #medicalbills ♬ Monkeys Spinning Monkeys – Kevin MacLeod That clip walked TikTok viewers in the course of the process of the use of dollarfor.org to cope with incredible scientific debt by means of the "Debt Forgiveness" tab. the first visible comment turned into from a TikTok consumer; it study:

[because] of your video clips i was able to get my last debt (~$eleven.5k) from my labor forgiven by my health facility. thanks so a lot, you're altering lives ❤️

Federal Poverty guidelines, in brief defined

@dollarfor's preliminary viral TikTok hinged generally on "federal poverty guidelines" or "federal poverty degrees."

The Federal Poverty stage (FPL) is a metric used by way of the united states executive for a couple of applications. On a branch of health and Human capabilities (HHS) entry concerning the FPL, HHS described the Federal Poverty level and provided up-to-date figures for 2021:

Federal Poverty degree (FPL)

A measure of profits issued each year by using the department of fitness and Human functions (HHS). Federal poverty stages are used to examine your eligibility for definite programs and merits, together with savings on industry medical health insurance, and Medicaid and CHIP coverage.

The 2021 federal poverty stage (FPL) earnings numbers below are used to calculate eligibility for Medicaid and the toddlers's medical insurance program (CHIP). 2020 numbers are just a little decrease, and are used to calculate mark downs on marketplace insurance plans for 2021.

$12,880 for people $17,420 for a household of two $21,960 for a family unit of 3 $26,500 for a family unit of four $31,040 for a household of 5 $35,580 for a family unit of 6 $40,a hundred and twenty for a family unit of 7 $forty four,660 for a household of eight Federal Poverty stage quantities are larger in Alaska and Hawaii. See all HHS poverty guidelines for 2021.

As HHS noted, the figures for 2021 differed a little from the 2020 FPL considered in the viral TikTok video. The figures for 2021 from HHS seem like for 100% of the FPL, whereas the desk in the screenshot started at 138 p.c of the Federal Poverty stage.

Is It real Hospitals should Forgive scientific bills as Described in @dollarfor's TikTok Video?

On January 19 2021, The Mighty pronounced on the viral video's recognition, explaining partially:

whereas many americans qualify for clinical debt forgiveness, hospitals regularly do not make this option visible to patients. There are distinct local and national agencies throughout the united states that may assist you navigate charity care cases at hospitals, including greenback For. in case your scientific bill has already been despatched to collectors which you can still follow for fiscal assistance and forgiveness … clinical forgiveness is covered under the least expensive Care Act.

In that excerpt, part of "hospitals commonly do not make this option seen to patients" linked to an October 2019 Kaiser family unit basis (KFF) publish, "sufferers Eligible For Charity Care as a substitute Get big bills," subtitled "Nonprofit hospitals admit they sent $2.7 billion in expenses over the course of a year to patients who likely certified for free of charge or discounted care." The lengthy piece all started with an instance of a patient who purportedly sought financial counsel, and become met with most important, intentional obstacles:

When Ashley Pintos went to the emergency room of St. Joseph medical core in Tacoma, Wash., in 2016, with a sharp pain in her abdomen and no insurance, a representative demanded a $500 deposit before treating her.

"She pointed out, 'Do you have $200?' I talked about no," recalled Pintos, who then earned under $30,000 at a company that made holsters for police. "She pointed out, 'Do you've got $100?' They were not quiet about me not having funds." however Pintos, a single mom with two children who [was 29 in 2019], advised state officers St. Joseph by no means gave her a economic help application kind, even after she asked.

Pintos pointed out she was examined and discharged with guidance to purchase an over-the-counter pain medication. Then St. Joseph sent her a bill for $839. When she couldn't pay, the health facility referred the invoice to a collection company, which she pointed out damaged her credit score and resulted in a better interest price when she utilized for a loan.

St. Joseph denied erecting boundaries to charity care. however the health center's proprietor settled a lawsuit from the state attorney everyday earlier this year [2019] alleging such practices and agreed to pay more than $22 million in refunds and debt forgiveness.

within the very subsequent paragraphs, KFF/KHN brought:

under the least expensive Care Act, nonprofit hospitals like St. Joseph are required to provide free or discounted care to patients of meager incomes — or possibility losing their tax-exempt popularity. These rate breaks can help americans avoid economic catastrophe.

And yet well-nigh half — 45% — of nonprofit health center companies are routinely sending scientific expenses to sufferers whose incomes are low sufficient to qualify for charity care, in accordance with a Kaiser health news evaluation of experiences the nonprofits submit annually to the interior revenue provider. those 1,134 groups operate 1,651 hospitals.

KFF mentioned several specific examples, choosing the IRS as an information supply. One excerpt indicated that the guidelines viewed within the TikTok video may now not be universally applied:

while some hospitals say they write off the debt of negative sufferers without ever resorting to collection measures, a couple of hospitals whose practices had been highlighted in information reviews this 12 months [2019] for aggressively suing sufferers admitted to the IRS they knew many unpaid bills might have been averted through their financial tips policies … The IRS leaves it up to each and every health facility to make a decision the qualifying criteria. a comparatively beneficiant hospital can give free care to people incomes lower than twice the federal poverty level — round $25,000 for an individual and $50,000 for a family of four — and might deliver coupon codes for individuals earning as much as double that.

The Mighty also linked to a quotation that the ordinary scientific invoice recipient may not quite simply locate on the web page of the inner earnings service, IRS.gov: "economic guidance policy and Emergency medical Care policy – area 501(r)(four)." It become not convenient analyzing, however its preliminary part held:

in addition to the popular necessities for tax exemption under area 501(c)(3) and revenue Ruling sixty nine-545, medical institution corporations have to meet the necessities imposed via area 501(r) on a facility-via-facility foundation with a purpose to be handled as an organization described in section 501(c)(three). These additional necessities are:

group fitness needs assessment (CHNA) – section 501(r)(3), fiscal information policy and Emergency medical Care coverage – area 501(r)(four), quandary on expenses – part 501(r)(5), and Billing and Collections – part 501(r)(6). part 501(r)(4) requires a clinic firm to establish a written economic tips coverage (FAP) and a written emergency scientific care policy for a sanatorium facility it operates.

Its subsequent area lined IRS necessities for a hospital's financial counsel coverage, or FAP, decreeing it "must apply to all emergency and other medically vital care provided by the health center facility, including all such care supplied in the hospital facility by using a extensively-related entity":

The written FAP must be broadly publicized and include:

Eligibility criteria for economic counsel, and even if such tips comprises free or discounted care The basis for calculating quantities charged to sufferers The formulation for applying for economic advice For a health facility facility which does not have a separate billing and collections coverage, the moves that may well be taken within the adventure of nonpayment, If applicable, any counsel obtained from sources other than a person in the hunt for monetary counsel that the sanatorium facility makes use of, and no matter if and below what circumstances it uses prior FAP-eligibility determinations to presumptively examine that the individual is FAP-eligible, and, an inventory of any providers, aside from the medical institution facility itself, delivering emergency or different medically imperative care within the health facility facility that specifies which suppliers are coated through the FAP and which are not. Subsequent sections had been titled "FAP ought to be widely Publicized" and "generally available on a domain" — ironically together with that a directive requiring information on the subject matter be handy to discover and decipher:

undeniable Language abstract of the FAP

The simple language summary of the FAP is a written remark that notifies an individual the sanatorium facility presents monetary counsel beneath a FAP and that gives additional info in language that is obvious, concise, and simple to understand.

the first portion of the IRS web page excerpted above contained six hyperlinks, which we opened in quest of a minimum p.c of the FPL within the regulations. normal, the IRS citations were vague, lacking percentages of the FPL:

… youngsters, a health center facility can also no longer define its community in a means that excludes medically underserved, low-revenue, or minority populations who live within the geographic areas from which it attracts its patients (until such populations don't seem to be a part of the clinic facility's goal inhabitants or suffering from its predominant functions) or in any other case should be protected in keeping with the method the clinic facility makes use of to outline its neighborhood.

… A clinic firm meets the requirements of part 501(r)(5) with respect to a hospital facility it operates most effective if the clinic facility (and any extensively-linked entity) limits the amount charged for any emergency or other medically crucial care it provides to a FAP-eligible individual to now not extra that the quantity generally billed (AGB) to individuals who've insurance overlaying such care.

An August 2015 editorial published in the AMA Journal of Ethics, "IRS suggestions Will no longer stop Unfair hospital Billing and assortment Practices," explained that the policies had been mandatory however subject to more than a few percentages:

There are two leading gaps in the IRS guidelines' protections. First, they do not follow to for-income or executive-run hospitals, which make up greater than forty % of all hospitals in the US. 2d, the suggestions give hospitals complete discretion to examine eligibility for fiscal guidance, which is the set off for the rules' protections. beneath the rules, as an instance, a clinic may undertake a narrow financial guidance policy with very restrictive profits requirements, exclude all patients with any kind of assurance even with out-of-pocket charges, or make making use of for financial tips so hard that few are able to finished the process.

[…]

in addition, health center fiscal information guidelines fluctuate significantly when it comes to generosity and terms. among the pattern of fiscal suggestions guidelines from 140 hospitals, eligibility cutoffs for economic assistance ranged from an earnings of one hundred percent of the federal poverty degree (FPL) to 600 p.c of the FPL. Many hospitals with monetary counsel guidelines offered free care to those with incomes as much as a hundred-200 percent of the FPL and sliding scale discounts above that threshold. although, some hospitals didn't offer any free care and only provided average coupon codes even to the poorest sufferers. Of the hospitals within the pattern that supplied eligibility tips according to coverage repute, a quarter excluded these with coverage from their monetary assistance guidelines altogether.

a further section brought up:

besides the fact that tips a couple of health center's tax status, financial tips, or invoice assortment practices had been quite simply ascertainable, the uneven protections of the IRS rules continue to be complex as a result of these components do not drive a affected person's choice of health center. Most sufferers select their hospitals according to their physicians' referral or because it is the closest in an emergency. This capability that whether or no longer a affected person is included via the IRS's reasonable billing and collection suggestions is a count number of good fortune and fiat. however the fiscal penalties for the affected person can be dire, the present rules requiring fair expenses and collection practices of some hospitals and never others creates a equipment of financial roulette.

a brief attempt to determine @dollarfor's claims led to a maze of jargon-heavy IRS pages, and a transparent photo of why the TikTok video stored spreading virally. Most americans didn't recognize about the within your budget Care Act (ACA) requirement, hospitals gave the impression to imprecise the counsel, and it became "erratically" available due to discretion on the a part of hospitals.

sanatorium economic tips policies [FAPs] by State

In 2019, the national consumer legislations center [NCLC] published a document [PDF], "an ounce of Prevention: A evaluate of health center economic suggestions guidelines within the States," which become, of their own words, "no longer an exhaustive checklist or description of every free or bargain care application obtainable in each and every state."

That doc outlined state-selected FAP necessities, explaining:

The affordable Care Act requires certain nonprofit hospitals with 501(c)(three) popularity to provide neighborhood merits, including monetary assistance for low-income patients. 26 CFR §1.501(r) ("501(r)") requirements encompass establishing a written fiscal guidance policy (FAP) and a written Emergency clinical Care coverage. youngsters, these requirements follow simplest to nonprofit hospitals, and the ACA and its enforcing rules don't specify any minimal necessities or eligibility criteria for monetary suggestions. If a nonprofit sanatorium fails to conform to these necessities, the affected person doesn't have a private appropriate of motion beneath the statute to are looking for redress for noncompliance, as best the IRS can enforce these requirements.

This record offers a short overview of the financial counsel policies in each and every of the 50 states and the District of Columbia, and looks at the stage of financial counsel mandated, or no longer, in each and every jurisdiction.

summary

A September 23 2021 Imgur repost of @dollarfor's TikTok assertion that "most hospitals within the united states are non-profits," and that "the medical institution will legally must forgive your medical expenses" if your family unit revenue is less than a percentage of Federal Poverty tiers (FPL) went viral like outdated iterations. before the viral TikTok put up looked, clinical journals and websites like KHN coated the ACA stipulation in question. besides the fact that children hospitals do retain some discretion within the parameters of the coverage, @dollarfor's declare is easily actual.