by means of Dennis Sadowski

a couple of weeks earlier than Christmas, Jessica Moreno and her three kids had been able to move from her folks' domestic in wood Dale, Illinois, backyard of Chicago, to their personal apartment just a few blocks away.

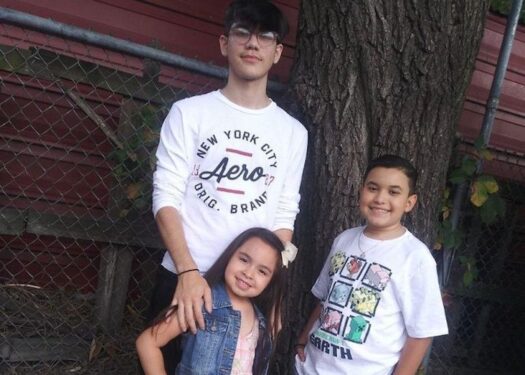

The infants of single mother Jessica Moreno of wood Dale, unwell., Julian, 16, Jenesis, 6, and Jayden, 12, are seen in an undated picture. Moreno used a sequence of $750-a-month tests below the multiplied baby tax credit software to rent an apartment for herself and her children and prevent becoming homeless. (image: CNS/courtesy Jessica Moreno)

The infants of single mother Jessica Moreno of wood Dale, unwell., Julian, 16, Jenesis, 6, and Jayden, 12, are seen in an undated picture. Moreno used a sequence of $750-a-month tests below the multiplied baby tax credit software to rent an apartment for herself and her children and prevent becoming homeless. (image: CNS/courtesy Jessica Moreno)"The condominium was heaven despatched," she pointed out. "i used to be looking at homelessness. i can't imaging being in that circumstance with three youngsters within the wintry weather."

Moreno, 34, who works part time as a paralegal, credit the $750 a month she received below the more desirable child tax credit score application for permitting her family unit to make the flow.

when you consider that the pandemic started very nearly two years in the past, Moreno had labored irregular hours as courts closed and the need for criminal work slowed. She and her toddlers moved into her folks' "tiny, teeny apartment." It was crowded, however all and sundry sacrificed so nobody could be out on the streets.

Moreno discovered in regards to the application and worked with case managers at Catholic Charities of the Diocese of Joliet, Illinois, to file the paperwork to acquire the better child tax credit score each month from July except December, when the program ended. She credited the company for its under no circumstances-ending work on her case.

The multiplied newborn tax credit application turned into enacted in March below the American Rescue Plan. It become the most fresh measure in a collection of legislative efforts to pump cash into the financial system in line with the fiscal downturn brought about through the onset of COVID-19.

The increased tax credit covered 2021 and referred to as for families with children to get hold of six monthly improve funds in preference to wait to declare the credit on their annual tax return. the provision raised the credit score to a highest of $3,600 for toddlers younger than 6 and $3,000 for children 6 to 17. The old credit score was capped at $2,000 per baby.

greatly, the credit grew to be "completely refundable," that means that children in families with the lowest incomes acquired the identical quantity as little ones in better households.

more than 61 million toddlers in additional than 36 million households benefited from the credit score, in response to a examine released Dec. 22 through the center on Poverty and Social policy at Columbia university. The month-to-month fee in November alone kept three.7 million children out of poverty, the center discovered.

earlier than the growth, 27 million children — together with about half of Black and Latino infants and half of toddlers living in rural communities — got lower than the complete credit score or no credit score because their households' incomes have been too low.

Moreno said the month-to-month advances below the elevated child tax credit score greater her family's existence.

"i used to be capable of do greater things for the children, get them school resources, pay for a few things, saved some for an condo and pay some expenses. I don't suppose i'd were able to do any of that devoid of these assessments," she stated.

despite the fact, the advance funds led to December. while she may be able to declare an additional volume of the credit on her federal tax return due April 18, she's expecting that making ends meet now will be extra tricky.

(Tax Day is constantly April 15, until it falls on a weekend or break, as it does this yr 2022, so it's been pushed to the subsequent obtainable business day.)

Moreno determined to share her story with Catholic information service in order to persuade the U.S. Senate to enact President Joe Biden's build returned more desirable Act, which includes a provision to lengthen the extended credit score through at least 2022. The apartment of Representatives narrowly accredited the bill in November.

Catholic groups and anti-poverty advocates are calling on the Senate to enact the bill, asserting the more desirable infant tax credit strengthens families and reduces poverty.

Presentation Sister Richelle Friedman, director of public policy at the Coalition on Human needs, spoke of she feared that failing to prolong the improved tax credit would cause thousands and thousands of little ones to fall lower back into poverty.

"We're working truly hard to make sure that the youngsters eligible for the elevated newborn tax credit are becoming it," she observed.

A letter final Sept. 7 from the chairmen of 5 U.S. convention of Catholic Bishops' committees to contributors of Congress primarily noted that the lengthy-latitude future of the country is "intimately linked to the neatly-being of families" in urging that the more advantageous credit score be made everlasting.

"The credit is intended to address infant poverty. that's something that Catholic social educating is in the back of. The infant tax credit score is among the most valuable tools that we must address child poverty," Julie Bodnar, domestic policy adviser in the USCCB office of domestic Social building, defined.

officers at Catholic Charities u . s . a ., including Anthony Granado, vp of government relations, are working with senators to circulate the tax credit score ahead as a part of the build returned enhanced Act.

Granado stated the accelerated infant tax credit score has been "fundamental for households who lost jobs, for low-earnings households, for people who don't get to work from their laptops (at domestic), working-category individuals who cannot have enough money newborn care."

Diocesan Catholic Charities companies are part of the power to be sure that the tax credit score continues as a minimum through 2022, Granado pointed out.

The legislation is stalled in the Senate.

Sen. Joe Manchin, D-W.Va., who's Catholic, has wavered on his aid for the invoice and has raised questions a few tax credit that doesn't encompass a work provision. within the chamber with 50 Republicans and 50 Democrats, Manchin's vote is needed to approve the measure, enabling vice president Kamala Harris to wreck the tie.

Manchin's workplace spoke back with a brief electronic mail to a CNS inquiry to talk about the invoice: "Senator Manchin has at all times supported the baby tax credit score and would like to see it targeted to those families who need it most."

Laura Peralta-Schulte, senior director of public policy and government affairs at community, a Catholic social justice lobby, talked about efforts are underway to attain out to Manchin to more advantageous clarify how the credit "is a transformational policy" that has eased the stifling results of poverty.

She pointed to findings from the Columbia school analyze that indicates individuals have used the funds for commonplace wants including food, expenses, clothing, school expenses and rent or a loan.

"There's so a lot dialogue concerning the dignity of families. The records shows that govt can play a role alleviating poverty and when americans get supplies they actually use them for the standard wants," Peralta-Schulte advised CNS.

because the lobbying endured, Moreno back to work Jan. 13 after she and her daughter dealt with disorder from COVID-19 for nearly two weeks. Her sons moved back in with her parents all through the ordeal.

Now she is concentrated on retaining her household housed and in faculty. She is looking for a much better paying job that offers greater hours whereas she contemplates a return to courses to conclude a school diploma at Governors State university, a ninety five-mile circular trip from wood Dale.

Financially, it's a fight, Moreno said.

"The $750 could be helpful."

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.